Beyond Price Per SF: The Real Metrics You Should Use to Compare Leases

By Chris Rohrer, Broker & Pete Kostroski, Broker | Rokos Advisors

Ask almost any business owner how they compare office or industrial spaces, and you’ll often hear the same answer: “We’re looking at price per square foot.”

And sure, price per square foot is a useful starting point. It’s a convenient way to compare different spaces on the surface. But the truth is, it’s only one piece of a much bigger puzzle.

Focusing on price per square foot alone can leave you blind to costs, risks, and opportunities that significantly impact your bottom line.

Here’s why smart businesses dig deeper — and the real metrics you should be using to evaluate your next lease or purchase.

Efficiency Matters More Than You Think

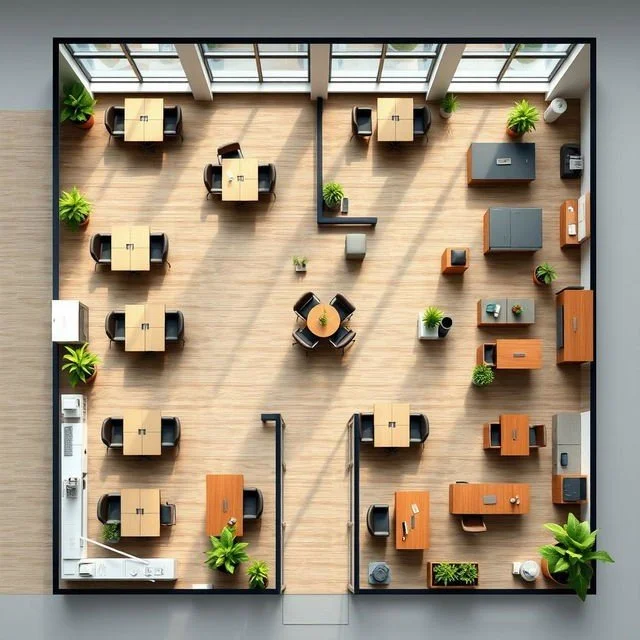

Imagine two office spaces, both priced at $25 per square foot. One has a perfectly efficient layout where nearly every square foot is usable. The other is chopped up with odd hallways, oversized lobbies, or unusable corners.

Even though the rate is the same, you’re effectively paying more for wasted space in the inefficient layout.

Test-fit drawings and space utilization studies can help you determine how much usable space you’re actually getting. Sometimes, a higher price per square foot can still be the better deal if the layout is more efficient.

Total Occupancy Cost > Base Rent

Businesses often fixate on the base rental rate — but total occupancy cost can tell a very different story.

Consider costs like:

Operating expenses (e.g. property taxes, insurance, utilities, common area maintenance)

Parking charges

Security services

Janitorial fees

Future capital expenses passed through to tenants

A building advertising a “low” rental rate might come with significantly higher operating expenses, making it more expensive overall than a space with a slightly higher rent but lower additional costs.

Tenant Improvement Allowances and Concessions

A landlord offering a high tenant improvement (TI) allowance might appear generous — but it’s essential to understand how that allowance impacts your deal.

Sometimes landlords recapture TI costs through higher rental rates or longer lease terms. In other cases, the allowance might not be sufficient to cover your full buildout, leaving you to bridge the gap out of pocket. Instead of just looking at the advertised rate, analyze how concessions, TI, free rent periods, or moving allowances affect your total financial commitment over the lease term.

Parking and Access Costs

Parking might feel like a minor line item. but it can have significant financial and operational impacts.

Downtown spaces often have expensive monthly parking fees, while suburban buildings might include parking at no charge. For industrial properties, yard space and truck courts can also carry hidden costs or limitations. Factor in these expenses to avoid surprises — especially if you’re comparing urban and suburban properties.

Building Infrastructure and Condition

Older buildings can look attractive on paper due to lower rental rates. But aging HVAC systems, elevators, roofs, or mechanical infrastructure could mean costly repairs or interruptions that landlords sometimes pass along to tenants.

Modern buildings might command higher rents, but they can also offer greater energy efficiency, lower operating costs, and fewer surprises. It’s crucial to evaluate the physical condition of any space you’re considering, beyond what’s listed on a rent schedule.

Alignment with Business Strategy

Price per square foot tells you nothing about how well a space aligns with your business goals.

Is the location convenient for clients and employees? Does it support hybrid work strategies? Can it accommodate future growth or contraction? Will the space reflect your brand to visitors and talent? These qualitative factors can have massive financial implications in the long run, even if they’re not immediately visible in the lease rate.

Price per square foot is a quick way to compare buildings — but it’s a shallow view that can be misleading if used alone.

The smartest businesses go deeper. They examine total occupancy costs, efficiency, infrastructure quality, and strategic fit to ensure their real estate decisions support both their budgets and their long-term goals.

Before you sign your next lease or purchase agreement, take the time to evaluate the full picture. Your business—and your bottom line—deserve it.

Wondering how your current space stacks up beyond just price per square foot? Rokos Advisors can help you analyze the true costs and value behind every option, so you can make the smartest move for your business.

Rokos Advisors is an award-winning Minneapolis - St. Paul based commercial real estate/tenant representation firm specializing in helping businesses find the perfect office or industrial space for their company.